Israel Keeps on Growing as a Major Center of Global Cybersecurity Innovation

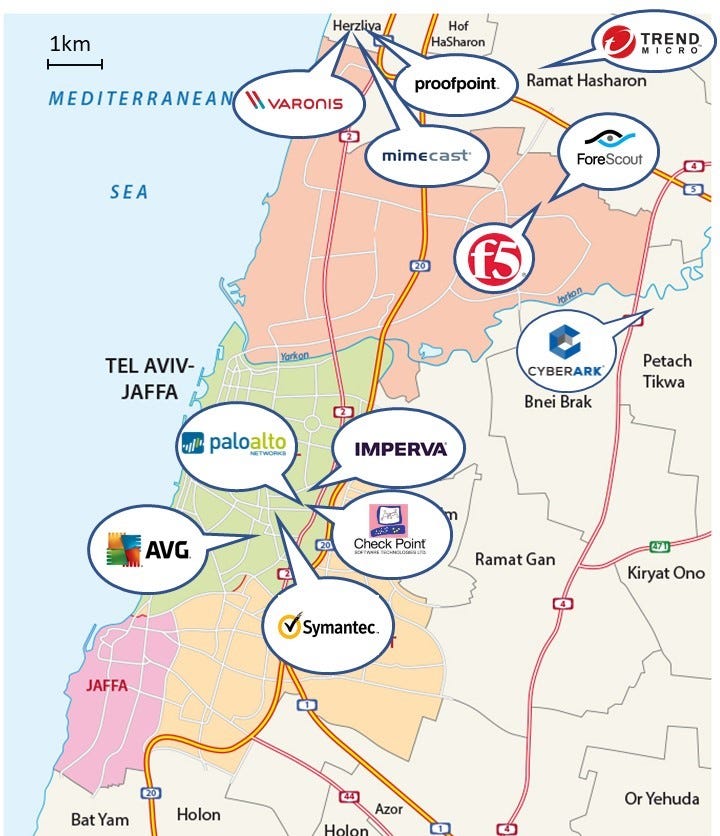

Israel is a major center of global cybersecurity innovation, as the acquisition of Solebit by MimeCast illustrates. This takeover is another one in a string of recent acquisitions of Israeli cybersecurity startups by public pure play cyber companies. MimeCast joins Symantec, Palo Alto Networks and Proofpoint that all acquired companies during the last 12 months to boost their innovative technology stack for keeping their competitive edge and expanding their product portfolio.

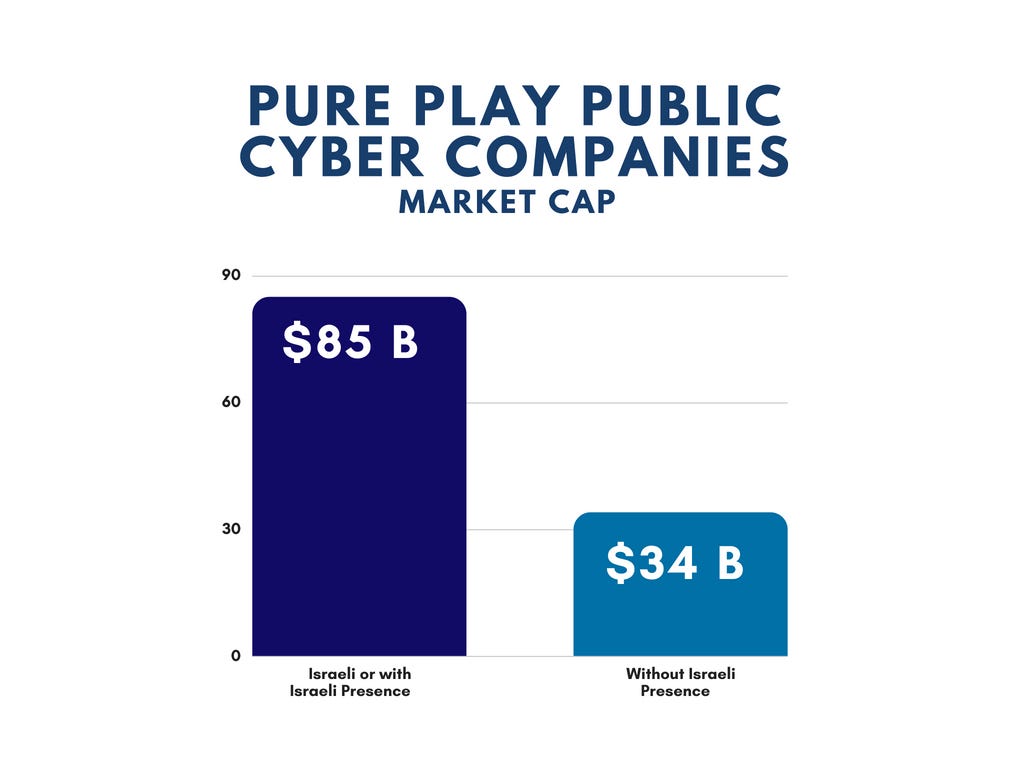

With five 100% Israeli and another six non-Israeli public cybersecurity companies that have a presence in Israel, the country continues to solidify its position as a global center of cybersecurity innovation. In fact, the combined market cap of the pure play cyber companies with Israeli presence far exceeds the one of those without, as the graph below shows:

Two major non-Israeli companies (with a market cap over $10B) are especially active. The first one it Palo Alto Networks (founded by the Israeli Nir Zuk) which has acquired Cyvera, LightCyber and recently also Secdo. The company is also rapidly expanding its Israeli R&D Center. Fun fact: This center is located right across its mega-rival Check Point. The second one is Symantec, which after no activities in Israel for many years, has now acquired Skycure (a mobile security startup) and Fireglass (active in Web Isolation). Similar to Palo Alto Networks, Symantec is also expanding its local R&D center.

But it’s not only pure-play security vendors that have a foothold in Israel. Non pure plays such as Microsoft, Cisco and IBM are also active within the Israeli ecosystem. Especially Microsoft has a dominant presence with 4 acquisitions of Israeli startups (Aorato, Adallom, Secure Islands and Hexadite) within the last 4 years under its belt. These takeovers paid off — most of its security products and its Azure cloud security platform are now being developed in its Israeli R&D center. In addition to these public companies, there are also a growing number of private companies (e.g., McAfee and AVG) that have active R&D centers in Israel thanks to acquisitions they made.

But that’s not all. Israel is also the main hub for two other nascent and fast-growing sectors, namely automotive and industrial cybersecurity. If we look at automotive, we see that startup Argus was bought by Continental, and that Samsung’s Harman acquired TowerSec. Automotive conglomerates such as General Motors and BMW have established R&D centers in Israel. As it looks now, Israel will be an integral part of the autonomous car revolution. On the Industrial cyber security side, companies such as CyberX and others are making their mark grabbing the attention of global CISOs.

Being a small country, all the companies mentioned above are based within a 10 miles radius of the center of Tel Aviv. This concentration is a huge benefit, since it makes it easy for young companies to find and hire talent, for investors to meet founders, and for global players to scout and connect with potential partners.

That all being said, what will be the future of the Israeli cybersecurity innovation? Will it become a hub of R&D centers for supplying talent and innovation to the US behemoths or will it continue to create major market players along the lines of Check Point or CyberArk?

To answer this question, it’s important to look at the strength of the Israeli cybersecurity ecosystem which is based on the following pillars:

- Vast pool of technology talent groomed by the National Cyber Operations. These experts join the private market at a relatively young age, eager to become the founders of the next big cyber company.

- The workforce of local cyber companies that has gained significant experience in developing enterprise software tailored to global markets.

- Commercial savviness which keeps on growing with the maturing and expansion of the Israeli ecosystem. Given the small size of the Israeli market, Israeli startups focus their market expansion mostly on the US and Europe. As a result, CEOs and other business executives were able to become builders of public companies and serial entrepreneurs. Some famous examples are: Shlomo Kramer (founder of Checkpoint and Imperva and now spearheading Cato Networks), Mickey Boodaei (founder of Trusteer and currently running Transmit Security) and Alon N. Cohen (founder of CyberArk).

- A community of experienced investors consisting of local and global ones with a strong Israeli presence, who are experts at finding and backing early stage cybersecurity startups.

All in all, we can conclude that the future for the Israeli startups looks bright as the ecosystem will continue to grow and generate more and more success stories. We can expect a new batch of Israeli companies going public within the next 2–5 years as well as more acquisitions of incumbents and new players.

What do you think? How do you see the future of cybersecurity? Please share your thoughts with us!

Dorin Baniel

Dorin Baniel

Kobi Samboursky

Kobi Samboursky