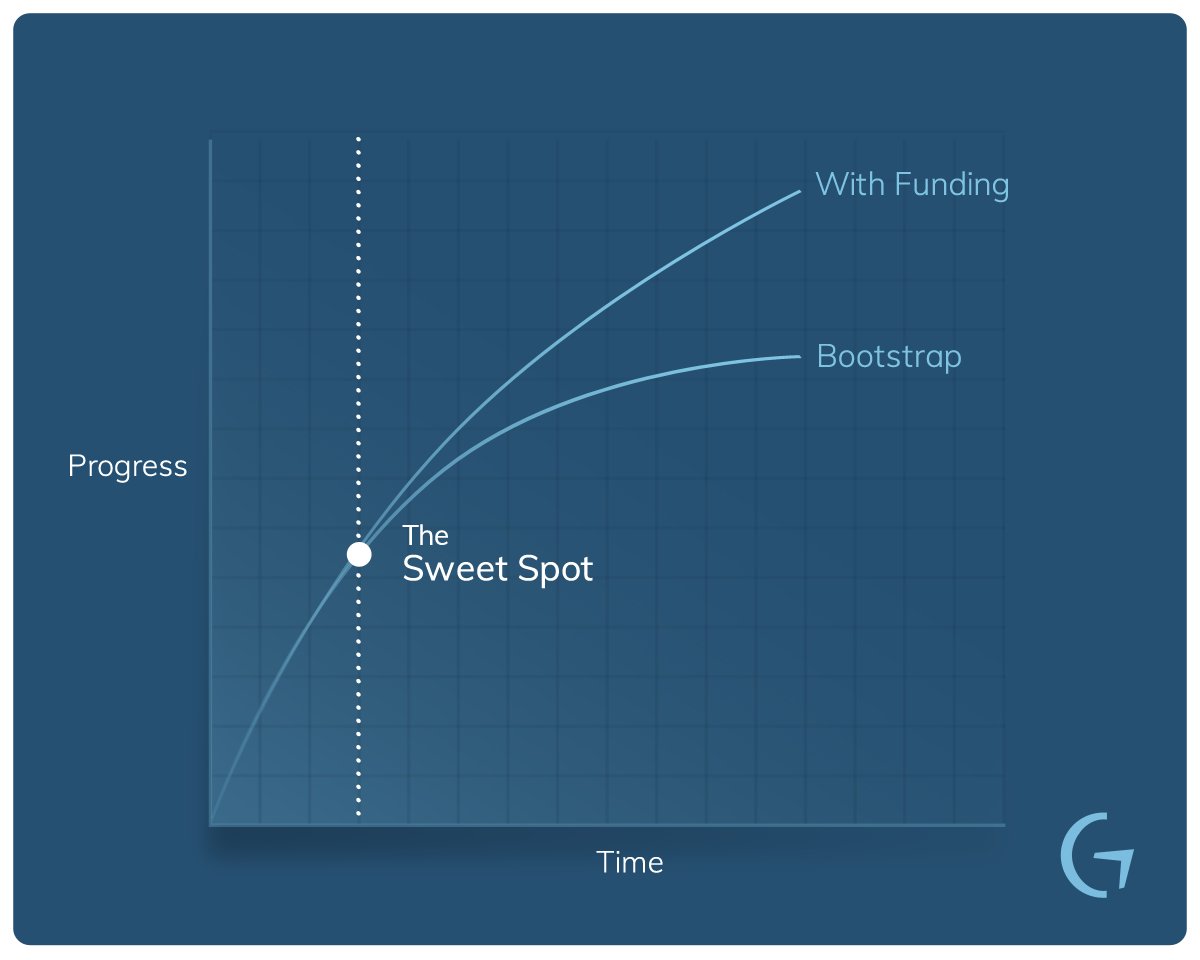

The Fundraising Sweet Spot

One of the questions that we often hear from entrepreneurs is about the optimal time to raise funds. While sometimes the first instinct is to secure as much capital as possible, as soon as possible, the reality is that there’s much more finesse to the fundraising process.

Finding the sweet spot

There’s always a tradeoff when raising funds, especially at an early stage. Naturally, the more funds you raise, and the earlier you do it, the more equity you need to forfeit. Different industries and product types bear different timelines and financial needs, and to find the right balance one needs to weigh in various factors before making the decision.

The initial period of a startup’s life is almost always the same — and requires a minimum financial investment. The first weeks are all about market research, vetting, identifying needs and formulating what’s required to create an MVP. How much money you have in the bank means only so much during that time; it’s on the founding team to put in the work first, and do so as fast as possible. However, at certain point money becomes the main barrier for rapid progress — and that’s the sweet spot you’re after.

How much can you do on your own?

After you have established your initial timeline and know what you need to get your MVP going, you might want to start raising funds. However, this process is industry specific. For example, if your venture involves developing proprietary hardware, you will most likely need funds quite early to get your first R&D hires and to create a working prototype.

On the other hand, if you’re creating a B2C software product, it is possible that you can bootstrap your way to a working MVP, and start to get a feel for your market. Obviously, beyond the pure business considerations, there’s only so much you can do on your own time and your own dime — so your personal ability to go bootstrap should also be a part of the consideration pool.

Keep your eyes on the market

Time to market is an important aspect for any venture. The timing of fundraising could be impacted by external conditions, which create a specific window that needs to be taken advantage of.

Other players in the landscape, a trendy sector and even a general momentum in the VC sphere are all relevant factors to consider upon deciding when to start raising.

Howdie, partner

When you decide that it is time to start reaching out to investors and secure your first financing round, you will need to have a clear idea of the amount of money you’re after. You should know exactly where the funds will be going and you should avoid giving a range that it too obscure. Saying that you need between $3 million and $4 million is reasonable. However, asking for $3 million to $6 million shows that you haven’t done your homework.

It is tempting to think that valuation is the key factor to look at, however, utilizing a more holistic approach should be the way to go. Building a company is a marathon, not a sprint. Therefore, your thinking should consider future financing rounds and your company’s long-term operations.

Your investors are managing a business and are expecting a return on their investments. Especially when it comes to your first rounds, investors will look for your valuation to double within 12–18 months. At the same time, future financing rounds will also most-likely be double, or even triple, the initial amount you raise — so don’t overshoot and keep your goals manageable. The optimal financing round is one that will enable you to follow your roadmap and reach your milestones over the next 12–24 months.

Picking the right partner is also of paramount importance. You need partners that can give you value — and value comes in more than one form. Deep pockets and a clear strategy of participating in future rounds are always good traits to look for, however, you should strive for investors who are relevant to the kind of venture you’re building and can bring a real value-add with them; this has more value the earlier the stage you’re in. The simple rule of optimizing for quality over quantity should be taken with great attention.

Keep a healthy hunger

Even if you find yourself in a situation where you can raise generous amounts, it is often wiser to pace yourself. Sometimes knowing that you don’t have much to burn is the best motivator for efficiency. You need hunger to stay motivated. Us investors will give you what you need, but we want to see you make the most of it. Your founding team and your first hires should all have this same sense of hunger and urgency. We’re not saying you should panic — but don’t overindulge yourself either. After all, we all got here due to hard work — and this is what we want to see.

This content was written in cooperation with my dear friend and colleague Roy Gotlieb, Partner at Cardumen Capital

Lior Litwak

Lior Litwak

Kobi Samboursky

Kobi Samboursky